How To Register A Section 8 Company?

Registering a Section 8 Company is quick, easy, and can be done online with Legalguard.in in 3 simple steps.

We help you obtain digital signature certificate.

We draft and file the documents required for registration (MoA, AoA & Declarations).

We help you with the post-registration formalities and compliances.

Section 8 Company - An Overview

A Section 8 company under the Companies Act, 2013 or a Section 25 Company as per the Companies Act,1956 is an organization registered with an objective of promoting the fine arts, science, literature, or knowledge sharing for a purposeful matter or for charity. These are the limited companies established under the Companies Act. The Government grants these companies an exclusive license under the Section 8 Companies Act. The three main conditions for granting the license is.

Checklist for Registering a Section 8 Company in India

As defined under the Companies Act 2013, we have to ensure the requirements of the following checklist

Two Directors

A private limited company must have at least two directors and at most, there can be 15 directors. Among all the directors in the company, at least one must be a resident of India. A private limited company can also be registered with only 1 director but that is called one person company (OPC).

Unique Name

The name of your business must be unique. The suggested name should not match with any existing companies or trademarks in India.

Minimum Capital Contribution

There is no minimum capital amount for a company. A company can be registered even with a capital of Rs. 1,000/-

Registered Office

The registered office of a company does not have to be a commercial space. Even a rented home can be the registered office.

Documents Required for Section 8 Company Registration

In India, Private Limited company registration cannot be done without proper identity and address proof. These documents will be needed for all the directors and the shareholders of the company to be incorporated. Listed below are the documents that are accepted by MCA for the online company registration process.

Identity and Address Proof

- Scanned copy of PAN Card. Foreign nationals must provide a valid passport (Shareholders and Directors)

- Scanned copy of Voter’s ID/Passport/Driver’s License/Aadhar (Shareholders and Directors)

- Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill (Shareholders and Directors)

- Latest Passport size Color photograph of all the promoters (Shareholders and Directors)

For foreign nationals, an apostilled or notarized copy of the passport has to be submitted mandatorily. All documents submitted should be valid. The residence proof documents like the bank statement or the electricity bill must be less than 2 months old.

Registered Office Proof

- Latest & Clear Telephone Bill/Electricity Bill/ /Water/Gas Bill of the registered office address

- No Objection Certificate from the owner(s) of the premises of the registered office.

Note: Your registered office need not be a commercial space; it can be your residence too.

Why register Section 8 Company - Benefits

The following are the advantages of incorporating a Section 8 company over other modes of registering an NGO:

- It has organised operations and greater flexibility.

- Avoids meticulous registration process and no physical presence required.

- No requirement of a minimum paid-up capital.

- Seamless procurement of tax benefits under section 12AA and 80G of the Income Tax Act.

- Any partnership firm can be a member in its individual capacity.

- Can be registered with only 2 members as against the requirement of 7 persons for registration of the society.

- More creditworthiness and goodwill as it is registered with the Central Government of India.

- No other NGO can be registered in India with a similar name.

- All filings including the filing of the balance sheet with ROC and other activities such as name change, office address change or all other kinds of change is done online.

- Most preferred from the point of view of grants by Government.

- Most preferred from the point of view of CSR funding.

- Easy to transfer ownership in comparison to trust and societies.

- Can be verified online on the website of the Government.

- Voting rights are in percentage and hence only 1 person can hold 99.99% voting rights and thus it is easy to take policy decisions.

- It is a national level NGO.

- It can be converted into a normal Private Limited or Public Limited Company anytime.

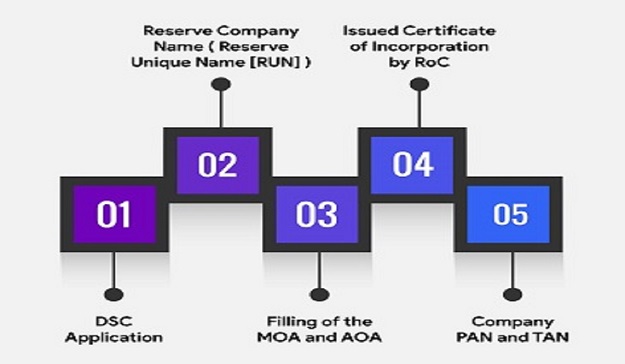

How to Register a Section 8 Company Online - A Detailed Registration Process

The Ministry of Corporate Affairs governs the Section 8 company registration process with rules and regulations framed following the law.

- Step 1: Application for DSC (Digital Signature Certificate).

- Step 2: Application for the name availability.

- Step 3: Filing of the eMoa and eAoA to register a private limited company along with ESI-PF, PAN & TAN application

- Step 4: Issued certificate of incorporation by RoC with PAN and TAN

Search the Name before Company Registration

One of the primary steps in Section 8 Company Registration is to ensure that the company name has not already been taken by another legal entity. We can run a company name search to check the availability of the particular name in India against the MCA and trademark database.

The Company name can be checked in MCA Database

@ http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do

and in Trademarks Database

@ https://ipindiaonline.gov.in/tmrpublicsearch/frmmain.aspx

We recommend the businesses to come up with three to four alternative names. The Ministry of Corporate Affairs will be the final authority to approve the name based on the availability rules and regulations.

If you are disappointed that a preferred name is taken, do remember that the name of your company doesn't have to be your brand name.

Name Structure of Section 8 Company

A section 8 Company can be registered either in the form of Private Limited or Public Limited Company but unlike a normal Private Limited or Public Limited Company, the name of a section 8 Company does not end with words "Private Limited or Public Limited". Rather the name of section 8 Company must end with words Foundation, Forum, Association, Federation, Chambers, Confederation, Council, Electoral Trust and the like, etc.

Applicability of Tax Exemption

There is a general notion that a Section 8 company need not pay tax as they work towards the welfare of the public at large. But this is not true. A Section 8 company, like trust and society, is liable to pay tax. In order to be exempted from Tax, a Section 8 company is required to obtain certification for the said exemptions such as Section 12 A, 80G etc. from the Income Tax Authorities.

What you get after Section 8 Company Registration

Legalguard.in Section 8 Company Registration Package Includes:

Why Legalguard.in

Access To Experts

We provide access to reliable professionals and coordinate with them to fulfil all your legal requirements. You can also track the progress on our online platform, at all times.

Realistic Expectations

By handling all the paperwork, we ensure a seamless interactive process with the government. We provide clarity on the incorporation process to set realistic expectations.

150-Strong Team

With a team of over 150 experienced business advisors and legal professionals, you are just a phone call away from the best in legal services.

Frequently Asked Questions

What to register - Trust, Society or Company?

Depending on the type of work you want to do, it is best to apply accordingly. For the best solution, contact one of our experts at Bizify.in for a better understanding as to which registration method suits your NGO the best.

How to register NGO?

First, you would need to pick a name, then check to see if it is already registered. If the desired name doesn’t exist yet, you can proceed to apply with the Registrar for a Certificate of Incorporation. The easiest way of registering your Non-Government Organization is by doing it with Bizify.in. We do all the work for you and you don’t have to bother about the running about for the process.

What are other alternatives to start and set up a Non-Profit Organisations?

If you do not want to start an NGO, you have other options by which you can help society. You can start a club, a volunteer service, be part of a local chapter of an already existing NGO and even be a fiscal sponsor.

Why do you need to register an NGO?

There are many reasons why it is better to register an NGO. One of the most important ones in funds. As an NGO you will receive funds from various quarters. The money you get from donors has to be put in a bank. To open a bank account under a company or an NGO, you need to have some documents. The registration of an NGO provides you with documents to show that funds are received in the NGO's name.

Can any government employees or officer be a member of NGO?

The answer to this question is yes. Government employees or officers can be part of NGOs provided the NGO is not anti-government. There are a few rules too that these people have to follow, one of them is to make sure that the NGO is not profit making.

How to open NGO?

Besides having the willingness to work for the welfare of society, legally, there are some procedures to follow, these are:-

- First, lay down the mission of your NGO, this means what cause you would like to take up.

- Form a governing body, this body ensure the smooth running of the NGO.

- Finally, register your NGO with the government authorities. This step can be long and painful. But, for a seamless experience, you can contact Bizify.in.

Our experts will help you at every stage of the registration process.